Want to learn how to generate income in retirement?

Ever wondered what Corporate Bonds are and how they can work in your investment portfolio. Come along to our free seminar and we’ll explain everything

book your seatCorporate Bonds are often mistaken by investors for having the same attributes as Government Bonds. But in reality, Corporate Bonds can provide returns of over 5% p.a.* and are very flexible as you can buy and sell them when you like.

With over 6,000 customers, at FIIG Securities we know that bonds are a fantastic fixed income option for those looking for stability and returns from their capital. You can choose from a range of over 300 Corporate Bonds to suit your investment needs and interests.

Are your cash investments going backwards?

With some cash rates currently lower than inflation, it’s possible your investments are actually diminishing, rather than growing so it’s a great time to diversify into Corporate Bonds.

Corporate Bonds with FIIG offer all the flexibility and liquidity of your cash and term deposits but with rates of over 5% p.a.*. You can also trade your bonds as you would shares.

Please be aware that Corporate Bonds have a greater risk of loss of some or all of your capital when compared to bank deposits.

*As at 05/01/17 and subject to change without notice and before fees. Please see our FSG for any applicable fees.

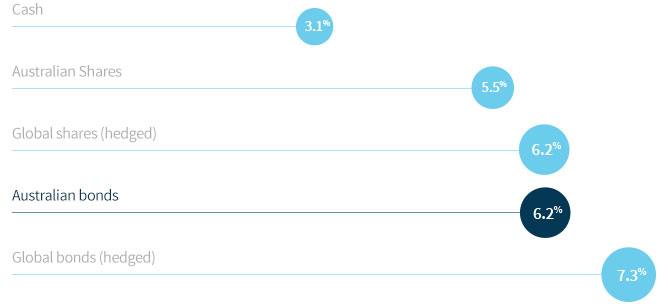

Earn a better return

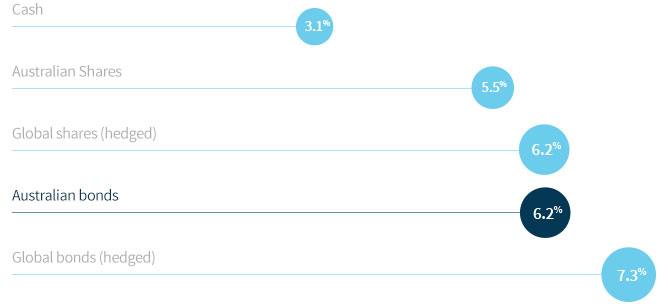

Corporate Bonds generally pay a higher income return than cash and term deposits.

Source: Gross returns for 10 years to December 2015 - ASX 2016 Long-term Investing Report May 2016

Predictable income

Corporate bonds provide the certainty of a regular predictable income – priceless when you’re making plans for retirement. Unlike shares, they are not connected to the profitability of the issuing company.

Capital preservation

At the end of the agreed term of your investment, the face value of the capital you invested must be returned to you. Simple as that.

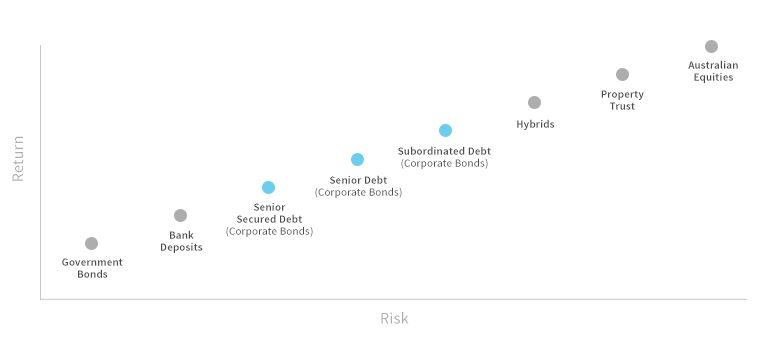

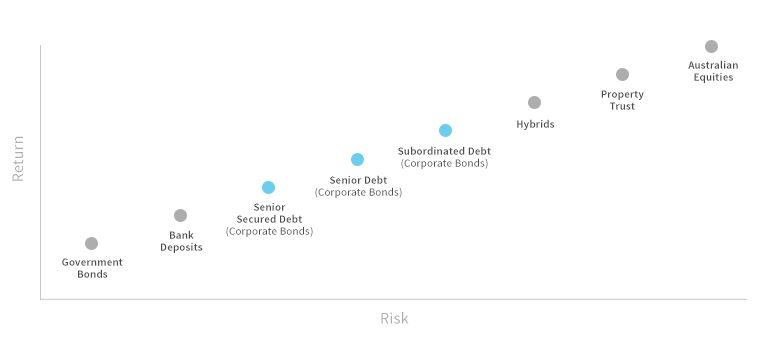

Bonds are a lower risk investment than shares.

Source: FIIG Limited

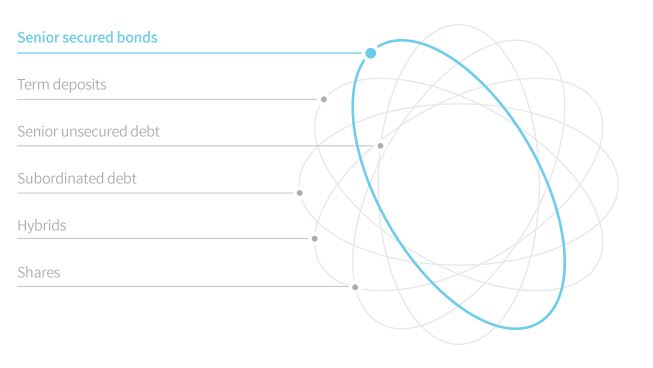

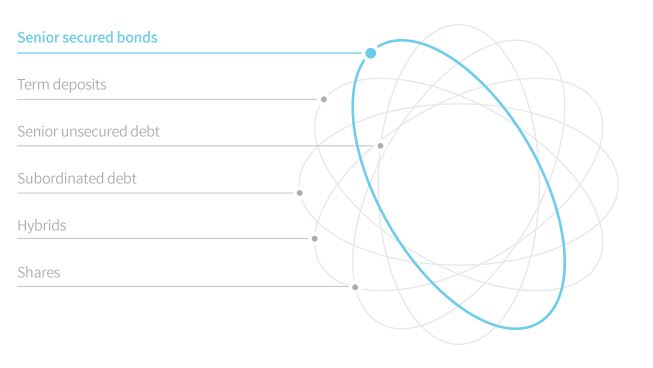

Diversify your portfolio

Diversifying your investments across different asset classes and markets is an important way to protect your wealth from the impact of market changes, interest rates, currency fluctuations and inflation.

Through bonds, you can also invest in assets that would otherwise be out of reach.

Earn a better return

Corporate Bonds generally pay a higher income return than cash and term deposits.

Gross returns for 10 years to December 2015 - ASX 2016 Long-term Investing Report May 2016

Predictable income

Corporate bonds provide the certainty of a regular predictable income – priceless when you’re making plans for retirement. Unlike shares, they are not connected to the profitability of the issuing company.

Capital preservation

At the end of the agreed term of your investment, the face value of the capital you invested must be returned to you. Simple as that.

Bonds are a lower risk investment than shares.

Source: FIIG Limited

Diversify your portfolio

Diversifying your investments across different asset classes and markets is an important way to protect your wealth from the impact of market changes, interest rates, currency fluctuations and inflation.

Through bonds, you can also invest in assets that would otherwise be out of reach.

As the fixed income experts, we’re only interested in helping our clients generate their income for their future. Because Corporate Bonds and fixed income is all we do, we’ve become very good at it.

We’re constantly searching for better ways to help our clients invest, and we’d love to help you do the same.

book your seat

We choose to hold seminars because we believe that people should be fully informed of all their investment options before making decisions that will affect their future.

We’re confident you’ll leave our seminar armed with the information you need to decide if Corporate Bonds are right for you.

The best way to find out if Corporate Bonds are right for you is by attending one of our short and informative FREE seminars.

You’re welcome to come along, ask us your questions and speak with our experts. Our seminars often fill fast, so don’t miss out - book your seat today.