The Australian Corporate Bond market

is growing

Recent research from Deloitte Access Economics revealed that Australia's corporate bond market

is growing, representing a large opportunty for high net worth individuals. Despite this, it is not

currently given the attention of other investment options in Australia.

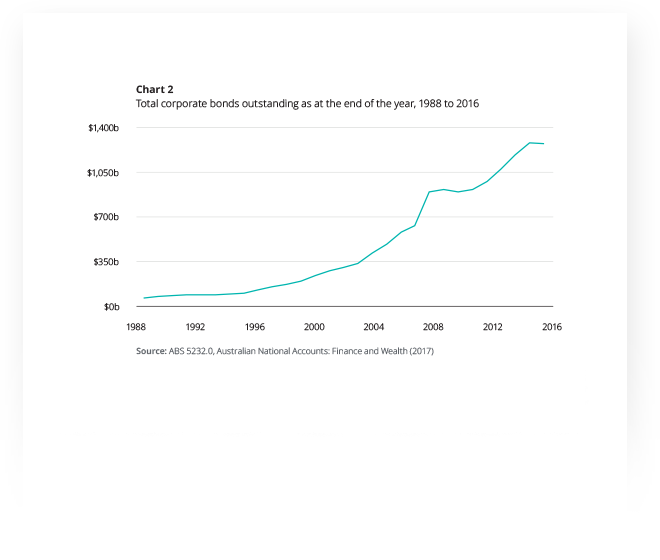

In Australia, the Corporate Bond market has grown by more than 40% since 2010

The market is around 70% the size of the listed share market (ASX), and there are currently over $1 trillion of Australian corporate bonds outstanding.

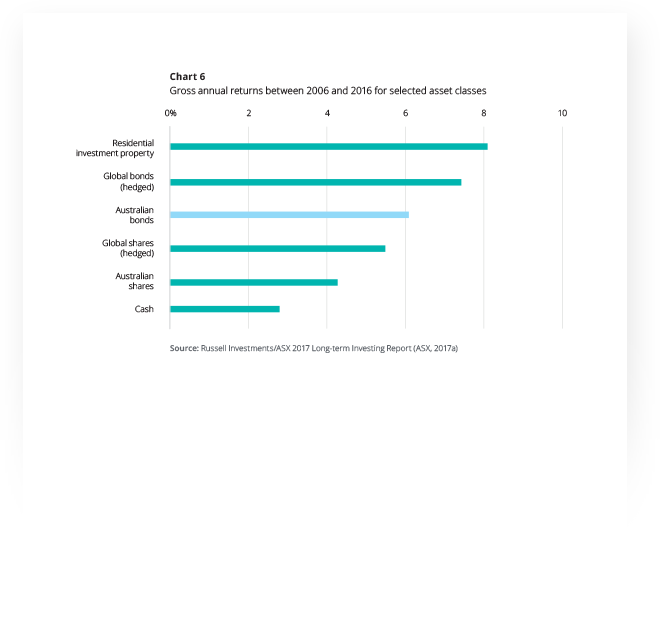

Average gross annual return for Australian bonds is higher than for Australian shares

The growth potential for bond investments is huge: average gross annual return for Australian bonds was 6.1% between 2006-16, compared to 4.3% for Australian shares.

Those who already invest in corporate

bonds intend to increase their investments

in the coming year

Research showed that 86% of corporate bond investors have had a positive experience,

and a net 37% intend to invest more in the next 12 months.

Of those who don't yet invest in corporate bonds, a net 15% intend to over the next 12

months, meaning the share of high net worth individuals owning corporate bonds could

grow from 16% to 29%.

Why do people invest in corporate bonds?

Individuals who invest in corporate bonds cite the following as the top reasons:

A reliable income stream

The level of return given the risk profile

Portfolio

diversification

Capital

Preservation

Corporate investors cite similar reasons for holding corporate bonds.

Download full Deloitte reportWhy there's huge opportunity

for Australian investors

Despite high returns and the huge available market,

current investment in bonds is much lower than other asset classes in Australia.

Only 16% of high net worth individuals in Australia directly own corporate bonds

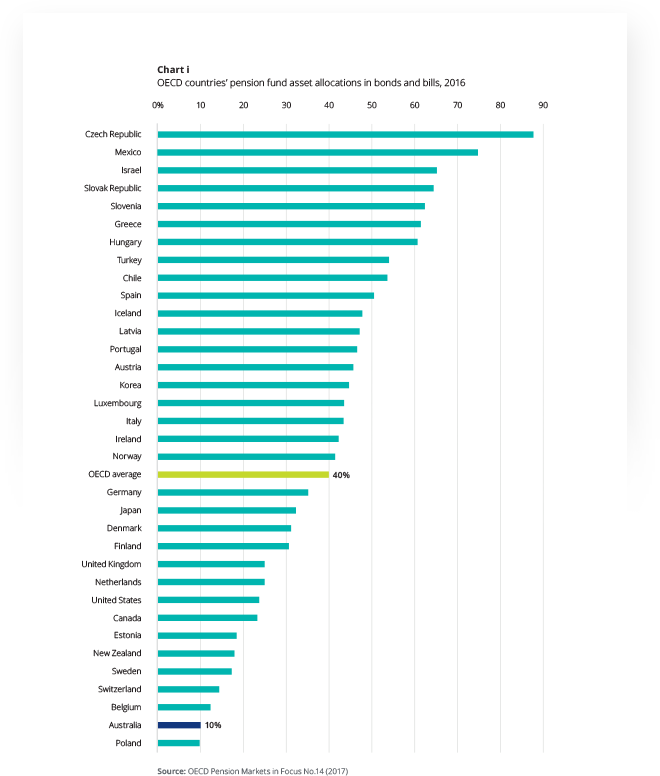

Only 47% of the corporate bond market is owned by Australian investors, and private investors hold less than 1% of all corporate bonds on issue in Australia (compared to almost 20% in the United States).

Corporate bonds are 11% of total portfolio assets for individuals with direct holdings

Direct investment in the fixed income asset class such as

corporate bonds remains underdeveloped in Australia compared

to other developed countries.

John O'Mahony Deloitte Access Economics Partner

Learn more in Deloitte's Corporate Bond Report 2018

- The latest trends in Australia's corporate bond market

- What's driving investor and issuer activity

- What's holding back market participation

- Why the Australian bond market is well positioned

for further development over the coming years

Your access to the

full report

Fill in the form below to get these insights and more

in the full Deloitte Corporate Bond Report 2018